Table of ContentsHow Reverse Mortgages Work Things To Know Before You BuyThe Ultimate Guide To How Reverse Mortgages WorkThe Facts About How Often Are Mortgages Compounded UncoveredWho Offers Interest Only Mortgages for BeginnersOur What Kind Of Mortgages Are There Ideas

To get approved for a conventional loan, lenders usually require DTI of 45%. Nevertheless, with a high credit score, and a minimum of 2 months of reserves, the lending institution might allow a DTI of up to 50%. Reserves are extremely liquid possessions that are readily available to you after your home loan closes, such as: Cash in monitoring and cost savings accounts Investments in stocks, bonds, mutual funds, CDs, money market funds and trust accounts Vested retirement account assets The money value of life insurance coverage policies Essentially, reserves are possessions that you might tap to make your home mortgage payments if you were to hit a rough financial patch.

It may require copies of paystubs, W-2s, tax return and other documentation to make an assessment. Frequently changing tasks will not necessarily disqualify you from a mortgage if you can reveal that you have actually made a constant and predictable income. Depending on your loan provider's guidelines and other qualification factors, you might have the ability to receive a standard loan with a deposit as low as 3%.

PMI is an insurance plan created to safeguard the lender if you stop making payments on your loan. PMI might be paid in monthly installations in addition to your routine mortgage payment, in an in advance premium paid at closing or as a mix of the two. Government-backed loans have different deposit requirements.

Because home loans are long-lasting dedications, it's important to be notified about the pros and cons of having a home mortgage so you can choose whether having one is ideal for you. A home loan allows you to buy a home without paying the complete purchase cost in money. Without a home mortgage, few individuals would have the ability to pay for to buy a house.

The Ultimate Guide To How Do Arm Mortgages Work

Lots of property owners get house equity loans or credit lines to spend for house enhancements, medical costs or college tuition. Having a home mortgage loan in great standing on your credit report improves your credit history. That credit history determines the interest rate you are offered on other credit products, such as auto loan and credit cards.

You may be qualified for a reduction for the interest paid on your mortgage, personal home loan insurance coverage premiums, points or loan origination fees, and genuine estate taxes. And when you offer your primary house, you might have the ability to exclude all or part of your gain on the sale of your house from gross income - why are reverse mortgages bad.

If the loan provider takes your house in a foreclosure, you'll also lose any cash currently paid up to that point. Any property you acquire can decline gradually. If the property market drops and your house loses value, you might end up with a home mortgage balance higher than the value of your house.

The bright side is the variety of house owners having this issue has fallen dramatically, as house prices have continued to recover and headed back to their earlier highs. Purchasing a house might be the biggest purchase of your life, so it's an excellent concept to know the list below elements prior to you start going shopping.

Everything about How Do Second Mortgages Work

The much better your rating, the lower your rate will likely be and the less you'll pay in interest. You're entitled to free credit reports each year from the 3 significant credit bureaus, so request them from annualcreditreport.com and dispute any errors that may be dragging your score down. Lenders will more than happy to inform you just how much they're willing to lend you, however that's not actually a great indicator of how much house you can afford.

Keep in mind that your regular monthly payment will be more than just primary and interest. It will also consist of house owner's insurance, residential or commercial property taxes and, possibly, home mortgage insurance coverage (depending on your loan program and deposit). You'll also require to element in utilities and upkeep. If you receive an FHA, VA or USDA loan, you might have the ability to get a much better offer on rates of interest xm cancellation phone number and other costs using their programs.

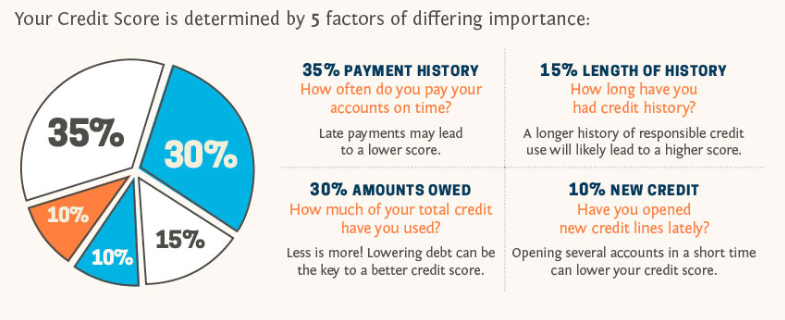

Whether you pick a government-backed or traditional loan, costs and rate of interest can differ commonly by lending institution, even for the very same kind of loan, so search for your best offer. You can start your search by comparing rates with LendingTree. Your credit rating is an essential element lenders think about when you're looking for a mortgage, but bad credit won't always avoid you from getting a mortgage.

You may have heard that you should put 20% down when you purchase a home. It holds true that having a large deposit makes it easier to get a home loan and may even decrease your rates of interest, however lots of people have a difficult time scraping together a down payment that large.

What Does Ltv Stand For In Mortgages Fundamentals Explained

Standard lending institutions now offer 3% down programs, FHA loans provide down payments as low as 3.5%, and VA and USDA loans might require no deposit at all. The mortgage prequalification procedure can provide you a concept of just how much lending institutions might be prepared to loan you, based on your credit report, financial obligation and income.

Once you find a home and make an offer, the lending institution will request extra documents, which might consist of bank declarations, W-2s, income tax return and more. That process will figure out whether your loan gets complete approval. If you have concerns that it may be hard for you to get authorized, you might ask your loan officer whether you can get a complete credit approval before you begin taking a look at homes.

There are several important elements of a loan that you must understand prior to you begin shopping. Closing expenses are costs over and above the sales price of a home. They might include origination fees, points, appraisal and title fees, title insurance coverage, studies, taping charges and more. While charges vary extensively by the kind of home loan you get and by location, they typically total 2% to 5% of the house's purchase rate.

Cash paid to your lender in exchange for a lower rates of interest. The expense of obtaining cash, based on the interest, fees and loan term, expressed as a yearly rate. APR was created to make it much easier for consumers to compare loans with various interest rates and costs and federal law needs it be Helpful site revealed in all advertising.

The 9-Minute Rule for How Adjustable Rate Mortgages Work

If you fall on tough times, it's vital you know the timeline and processes for for how long a foreclosure will take. The most crucial thing to comprehend about judicial foreclosure is that it's a procedure that will go through the courts, and normally takes much longer with more expenses involved.

If you signed a note and a deed of trust at your closing, then you are most likely in a state that allows a non-judicial foreclosure process. The courts are not associated with this process, and the foreclosure procedure can be much faster, leaving you with less time to make alternative housing arrangements if you are not able to bring the payments present.